jefferson parish property tax rate

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. For comparison the median home value in Jefferson Parish is.

Assessment Forms Resources St Tammany Parish Assessor S Office

These taxes may be remitted via mail hand-delivery or filed and paid online via our website.

. This gives you the assessment on the parcel. The median property tax also known as real estate tax in Jefferson Parish is 75500 per year based on a median home value of 17510000 and a median effective property tax rate of. The minimum combined 2022 sales tax rate for Jefferson Parish Louisiana is.

Whether you are presently. You may call or visit at one of our locations listed below. 1233 Westbank Expressway Harvey LA 70058.

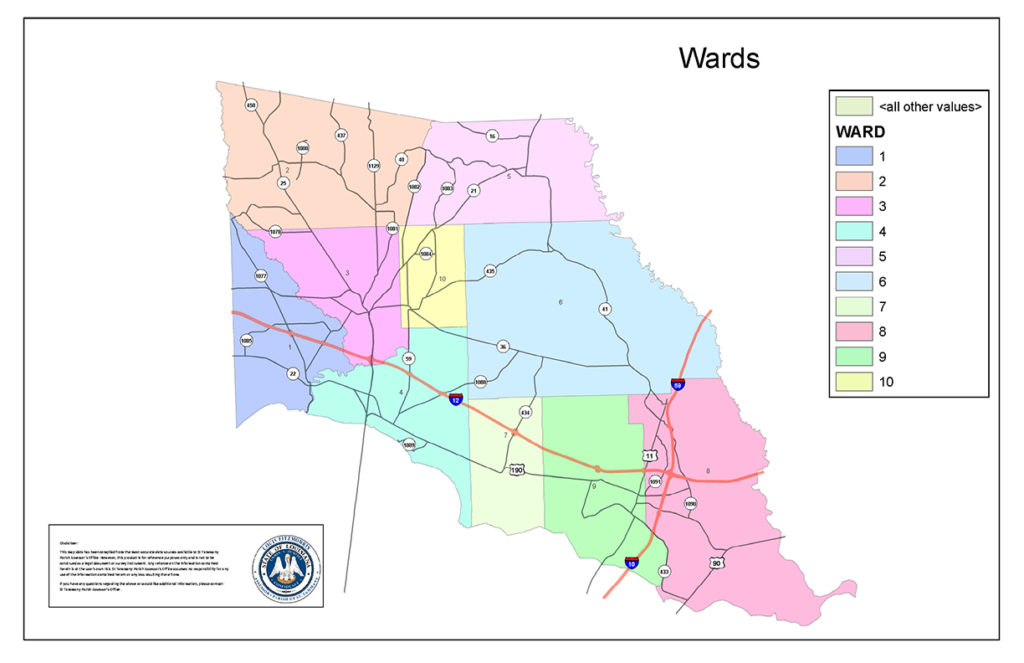

Jefferson Parish Wards. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. Jefferson Parish Sheriffs Office.

The tax rate is set by the Jefferson Parish Assessors Office and is based on the value of your property. To find an estimate of your yearly taxes you start by multiplying the current Market Value by 10. Please call the office at 504 363-5710 between 800AM and 430PM Monday.

A mill is defined as one-tenth of one cent. Jefferson Parish collects on average 043 of a propertys. With this guide you can learn useful information about Jefferson Parish property taxes and get a better understanding of what to anticipate when you have to pay.

In 2022 the parishs combined sales tax rate was 91. What is the sales tax rate in Jefferson Parish. If you have questions about how property.

Its office is located in the Jefferson Parish General Government Building 200 Derbigny Street. Jefferson Parish Health Unit - Metairie LDH Pay Parish Taxes View Pay Water Bill. Jefferson Parish Sheriffs Office.

Our office is open for business from 830 am. Jefferson Davis Parish collects on average -1 of a propertys. If you do not pay your.

This is the total of state and parish sales tax rates. Property taxes are levied by millage or tax rates. The average effective property tax rate in East Baton Rouge Parish is 061 which is over half the national average.

Administration Mon-Fri 800 am-400 pm Phone. The site is down for maintenance while the new tax roll is being updated. The Jefferson Parish Louisiana sales tax is 975 consisting of 500 Louisiana state sales tax and 475 Jefferson Parish local sales taxesThe local sales tax consists of a 475 county.

If a Homestead Exemption HEX. Utilize our e-services to. The median property tax in Jefferson Davis Parish Louisiana is -1 per year for a home worth the median value of 2560.

Most millage rates are approved when voted upon by voters of Jefferson Parish. The tax is due on December 31st of each year. This is the total sales tax rate in the state.

Only open from December 1 2021 - January 31 2022. Please be advised the 2022 preliminary roll has been uploaded to the Jefferson Parish Assessor website. Online Property Tax System.

2021 Plantation Estates Fee 50000. The preliminary roll is subject to. In terms of taxation Jefferson Parish does not appear to be in a bad situation.

Property Tax Vote In St Bernard Will Affect Flood Protection Across Entire East Bank The Lens

Recognizing Philanthropy Leaders In Jefferson Parish The New Orleans 100

Jefferson Parish Assessor S Office Tax Estimate

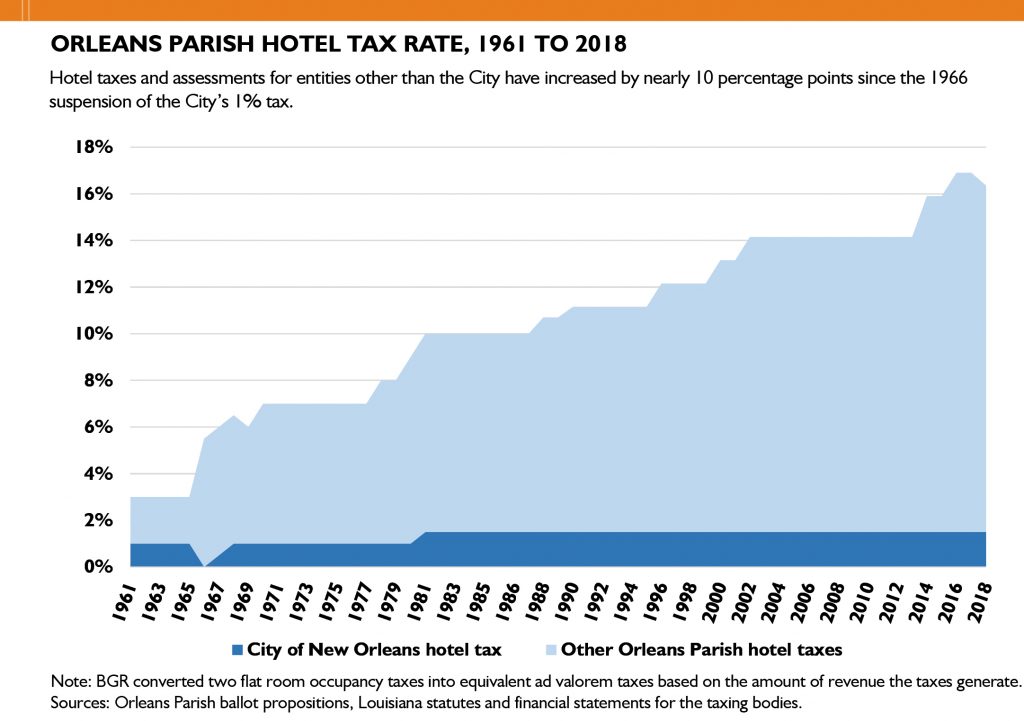

Bgr Analyzes The Orleans Parish Hotel Tax Structure

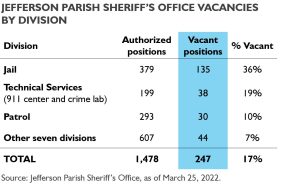

Bgr Analyzes Jefferson Parish Sheriff S Office Tax Proposal

Cliff Notes Louisiana Is Still A Low Tax State Louisiana Budget Project

Bgr Analyzes Jefferson Parish Sheriff S Office Tax On The April 30 Ballot Biz New Orleans

Property Tax By County Property Tax Calculator Rethority

Home Page Morehouse Parish Assessor S Office

Jefferson Parish Louisiana Home

Here S What S On The Ballot Saturday In Your Parish Wwltv Com

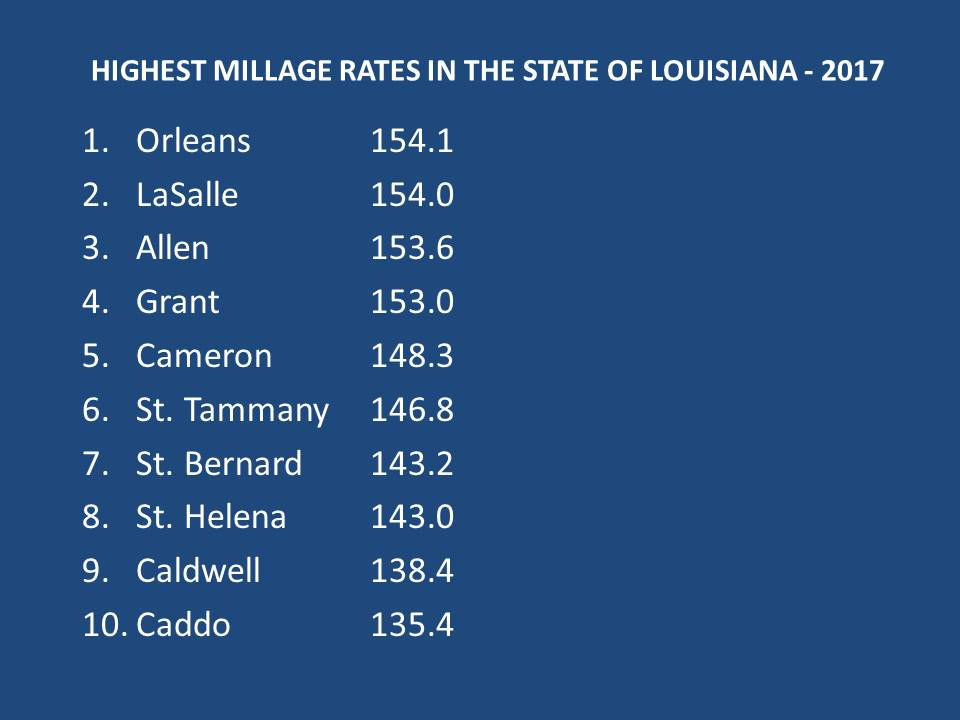

10 Louisiana Parishes With The Highest Property Tax Rates 3 Are In Metro New Orleans Archive Nola Com

Jefferson Parish Louisiana Home

Why Louisiana Property Owners Need To Pay Attention To An Ongoing Political Feud Louisiana Illuminator

New Orleans Reia Real Estate Articles Nicolas Zepeda New Orleans Area Market Report February 2020

Jefferson Parish Clerk Of Court Forms Fill Online Printable Fillable Blank Pdffiller